Table of Contents

Introduction

Background

Asian Participation in the Blockchain Ecosystem

Understanding the Multiplicity of Web3 Landscapes in Asia

Methodology

China Case Study

Background and Market Landscape

Cryptocurrency in China

The Central Bank Digital Currency of China

Blockchain in China

Takeaways

Hong Kong Case Study

Background

Motivations

Impact

Conclusion

Singapore Case Study

Introduction and Market Overview

Government Backed Collaborations

Regulatory Proposals

Going Forward

Conclusions

India Case Study

Background

Regulations

Conclusion

Philippines Case Study

Background

Catalysts to Adoption

Hurdles to Adoption

Conclusion

Discussion and Key Takeaways

Further Points of Discussion

Conclusion

Executive Summary

Even as the United States and other Western countries continue to fortify their stances on cryptocurrency and blockchain and take on a more draconian approach to regulating it, there has been increasing interest in the sector from Eastern governments, who are largely more open to having companies develop and incubate within their economy.

As such, we may begin to see many companies and protocols begin to shift or relocate into the East to take advantage of these opportunities.

More structured regulation / clear cut approaches to regulation exist in Asia, but may pose difficulties in terms of accessing Western markets and investment / liquidity from those systems.

Promising developments coming out of Asia, especially as Singapore / Hong Kong seek to become blockchain and financial technology hubs through allowing large volumes of development to happen within their regions, China continues to test their CBDC, and blockchain projects are developed.

Introduction

Background

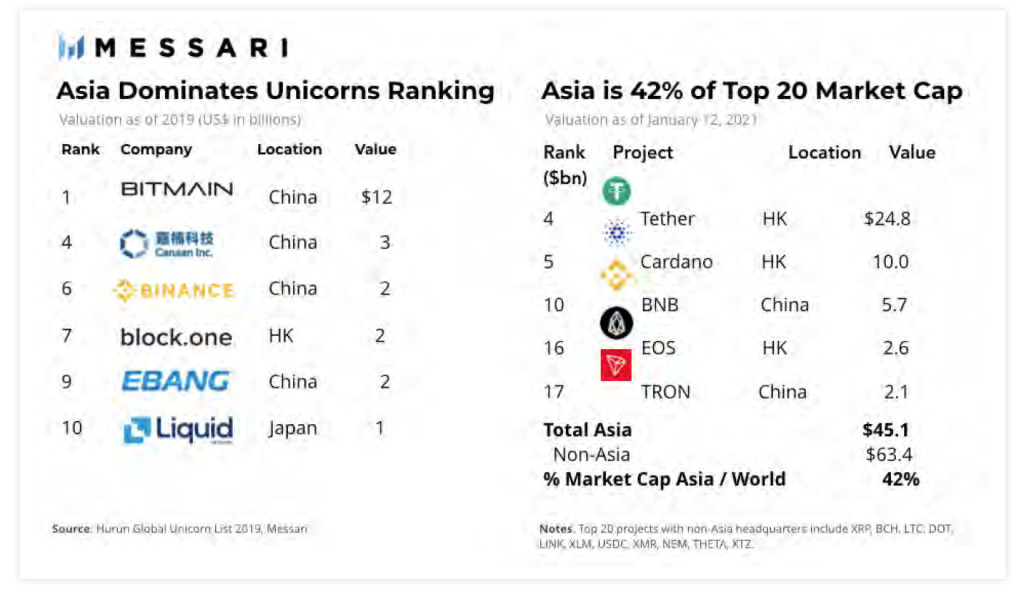

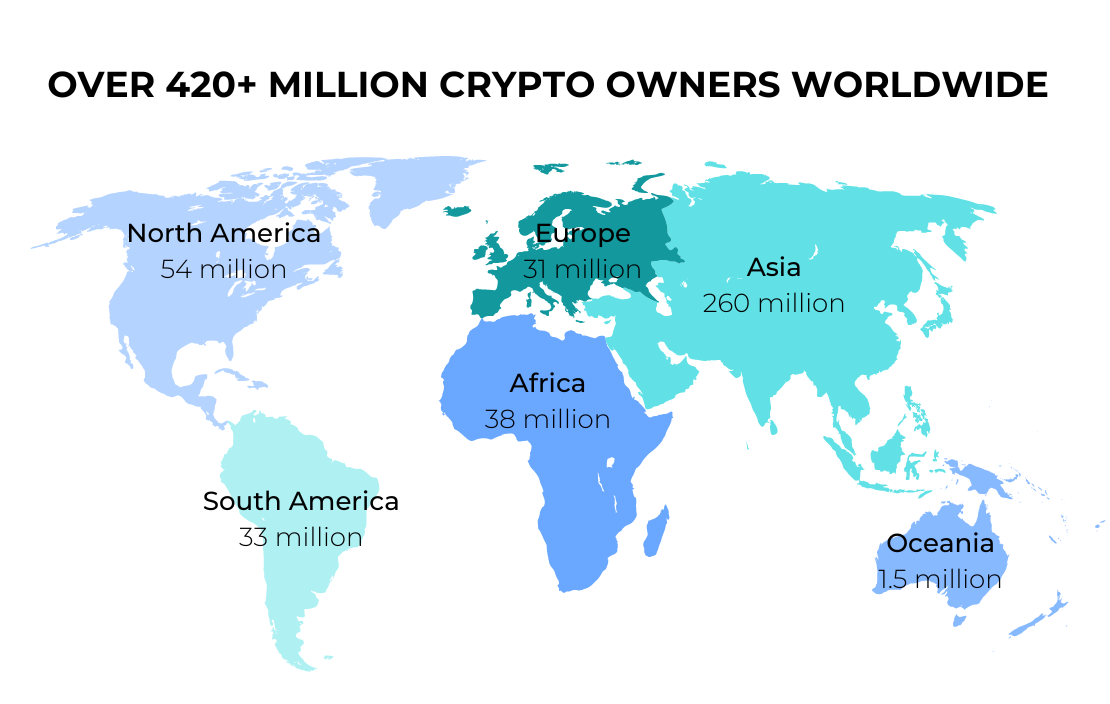

Asian economies have historically played an essential role in blockchain ecosystems, though governments have fluctuated between supporting their growth to acting as barriers to adoption. By the end of 2019, six of the top ten largest crypto firms in the world were located in Asia. As of the last 12 months ending in June 2020, Asia accounted for 43% of global cryptocurrency activity, or US $296 billion in transactions. Especially during the 2021 rally, participation from Asia contributed significantly to crypto transaction volumes. Today, of the top 20 token projects, over 40% of the market capitalization is based in Asia. Asian companies also account for 98% of ETH and 94% of BTC futures volumes.

With recent market crashes and companies collapsing across the board, policymakers are now accelerating consumer protection efforts within Asian countries, notably at differing intensities. As regulatory landscapes continue to evolve, Asia serves as fertile ground for insights around how contrasting socioeconomic conditions and history motivate divergent regulatory approaches, which in turn lead to varying degrees of blockchain adoption.

Asian Participation in the Blockchain Ecosystem

As the Web3 community continues to expand beyond the Western world and into markets across the globe, there is a pressing need for greater awareness regarding the differing standards and challenges that cryptocurrency adoption faces. Asian countries represent diverse manifestations of differing political and economic ideals, making it crucial to take into account the multiplicity of governmental powers across different regions of Asia. Many countries are distinct from their Western counterparts, and examining each country reveals a crucial lesson.

We aim to deliver high-quality analyses of historical context and case studies based in Asian countries that help enable data scientists, researchers, and all community members to better understand the limitations and opportunities that Web3 technologies face in frontiers outside of the traditional Western system.

Through our research, we intend to raise awareness and foster meaningful discussion within the community regarding richness of perspective when considering foreign governments and financial systems and a more inclusive approach to integrating Web3 technologies when approaching regions that differ from traditional Western financial systems.

We will primarily achieve this through synthesis of the history of blockchain adoption and previous financial movements in China, Hong Kong, Philippines, India and Singapore and identify novel insights about how to drive meaningful crypto usage in Eastern economies.

Lastly, our aim is to discover possible misunderstandings about cryptocurrency that the ecosystem and governments should acknowledge and be educated on, to develop more knowledge-driven perceptions.

Understanding the Multiplicity of Web3 Landscapes in Asia

The seemingly Western-centric nature of blockchain technology and cryptocurrency adoption, such as values of decentralization and deregulation embraced by the ecosystem as a whole, creates the misleading semblance that Western activity is at the forefront of Web3 development and greater global adoption of blockchain technologies and digital transactions. Sure, at the very core of Web3 technology is the drive to give power to the users in the form of ownership and creation of capital, which seems relatively misaligned with the perceptions of many Asian government models widely held in the United States and similar regions. Still, there’s a severe lack of appreciation and attention placed on understanding the role of Asian economies and the systems that drive such high volumes of activity on-chain and in exchange systems, as well as the hubs of innovation located in Asia that have contributed not only regulatory landscapes, but investment and governance approval to the development of emerging technologies in the space. The issue at hand is not working towards encouraging the adoption of blockchain technologies and cryptocurrencies in the East – where there are more than 260 million users, a larger market region than any other region in the world – but rather, the lacking understanding of the massive role and backing that Asian economies have had in driving the ecosystem to where it stands today. This research paper intends to debunk misconceptions surrounding the economies and regions that contribute so heavily to the ecosystem, understanding more about those areas and the changing regulatory landscapes, and probing future discussion within the ecosystem such that there is greater awareness amongst the Web3 community and a narrative about blockchain and cryptocurrency that is inclusive of countries outside of Europe and the Americas.

At the very least, this research paper aims to illustrate the diversity amongst the ways that pan-Asian economies intend to interact with these emerging technologies, and how the various events of the past few years have driven governments to uniquely leverage the strengths of new technologies and innovation while protecting investor interests and economic stability for citizens. It’s difficult to talk about blockchain adoption in Asia as a whole, when neighboring regions could have drastically different approaches and attitudes to the space. The goal of this research paper is to break down some of the major events in each region from the past decade in order to achieve a greater understanding of the cultural implications of Eastern tradition in blockchain technology and the ways in which it is regulated. We focus on just five key regions: China, India, the Philippines, Hong Kong, and Singapore, but believe the variable and dynamic nature of the landscapes in those places allow us to develop a greater understanding of how regulations vary amongst regions and the different intentions that governments may have within the space. We hope to draw a distinction between the interests of the people and the greater interests of regulatory powers as well, in some cases. In others, we will focus greatly on how the events of the past year have led to interesting new movements in the regulatory space, and how it might continue to shift in the future in response to new ecosystem growth and alterings. We will briefly go over the case studies we intend to analyze, and explain the perspective from which we aim to understand them and draw insights from them.

China

China has continued to enforce the “blockchain, not bitcoin” stance since 2019, when President Xi called for accelerated blockchain adoption before banning cryptocurrency transactions in 2021. While centralized attempts to implement blockchain technology such as the central bank digital currency (CBDC) and the recently launched China Digital Assets Trading Platform have seen little traction, significant adoption of crypto exists in trading (Chinese accounts made up 8% of FTX customer base pre-collapse) and bitcoin mining (as the second largest bitcoin miner in the world) despite regulations. Our research will focus on the misalignment between government policy and citizen action, and investigate the role that China’s interest in the digital yuan might play in regulations going forward or next action steps for the government.

Hong Kong

As crypto-asset markets have continued to evolve following the HKMA’s January 2022 discussion paper regarding regulatory frameworks for stablecoins, Hong Kong has worked to develop a risk-based approach towards stablecoin structures for regulation under the proposed regime. They are still working to determine the pros and cons between new legislation and amending existing laws that prepares for the further integration of stablecoins within their economy. As such, their cautionary approach coupled with relative acceptance towards the adoption of cryptocurrencies within the Hong Kong economic and political landscape presents an unique and noteworthy case study that illustrates the multiplicity of perspectives towards blockchain in Asia that we would like to explore. Our research will focus on providing commentary in respect to recent notable market and regulatory developments.

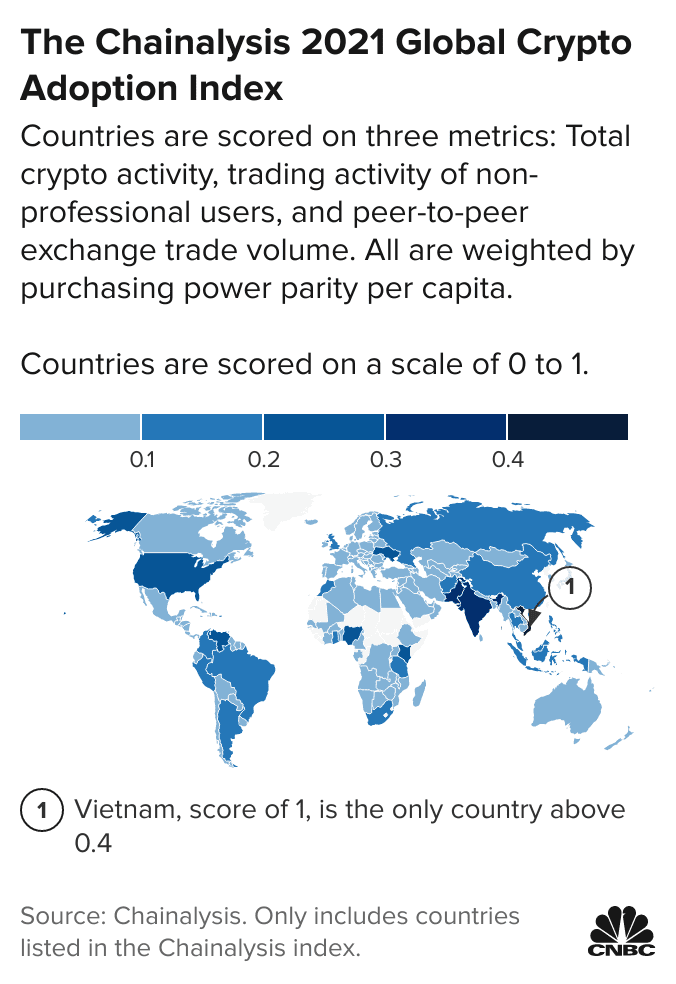

The Philippines

The Philippines leads in retail adoption of crypto second only to Vietnam, with a penetration of 15%. As a developing economy with consistent inflationary pressures on the peso, crypto is commonly used for remittances and payment. For the large unbanked and underbanked population in the Philippines, crypto is appreciated for its security, low transaction fees, and fast transaction times. Further, the government itself has demonstrated increasing intent in developing blockchain use cases in the country, such as initiating a pilot project on issuing CBDC in addition to implementing blockchain training programs within agencies such as the Department of Science and Technology. Our research will focus on understanding the catalysts and hurdles that will shape the Philippines' path to becoming a blockchain hub moving forward.

Singapore

The Singaporean blockchain market has the potential to reach a range of market spending between $1.9B and $2.6B by 2030. Since 2013, the Monetary Authority of Singapore (MAS) has cautioned consumers against the significant risks associated with digital transactions. Their most recent consultation period in December 2022 outlines a series of regulations that aim to protect retail customers and ensure stability in the digital payment market through cutting down on leveraged transactions and mandating base capitalization and other risk-regulating activities. The stance on cryptocurrency in Singapore is contradictory: they aim to become a cryptocurrency hub, yet have indicated hostility towards digital currencies and transactions, citing volatility and security issues. Still, they have shown their approval on blockchain technology in the past and have leveraged various projects, such as Project Ubin and Project Guardian. Our research will focus on analyzing the conditions in which Singapore has launched their recent crackdown on digital markets and working to understand what the blockchain community might look like there going forward.

India

Since taking over the G-20 presidency, India has made regulating crypto assets a priority in the group’s agenda, with the goal of creating a global Standard Operating Procedure (SOP) accepted by all countries. In March 2022, a 30% tax on crypto profits was implemented which drove a rapid decline in trading volume from India across major cryptocurrency exchanges, from 70% within 10 days to 90% in the next three months. Crypto traders moved to offshore exchanges and projects moved outside of India. Still now, India’s central bank, the Reserve Bank of India (RBI) has recommended a complete ban on cryptocurrencies such as bitcoin and ETH, viewing them as a threat to RBI’s authority. Our research will focus on how India’s perception of crypto has shifted in recent years, and identifying catalysts for the continuing crackdown.

Methodology

At the very basis of it, conducting case studies on various regions of Asia will allow the illustration of the dynamic and diverse landscape of Web3 adoption. Through these case studies, we hope to draw insights regarding the possible misconceptions held in the West regarding Asian involvement in the ecosystem, and understand how these changing regulatory landscapes might look going forward as 2023 unfolds.

China Case Study

Background and Market Landscape

China has historically been a controversial player within the global market, no matter the sector, and cryptocurrency is no different. Their rule of law and tightly controlled economy, paralleled by their efforts to escape Western influence while seeking dominance internationally, makes them uniquely positioned when it comes to their role in the ecosystem. China’s 13th Five Year Plan (2016 - 2020) centered on the promotion of RMB in the global landscape as a means of escaping the domination of US monetary policy and generating lower lending/borrowing costs, which aligns with a lot of their goals in the cryptocurrency ecosystem. Their struggle for currency hegemony has driven them to heavily leverage the digital yuan in their international efforts, despite their historical and ongoing crackdown on digital transactions and foreign cryptocurrency. China has continued to enforce the “blockchain, not bitcoin” stance since 2019, when President Xi called for accelerated blockchain adoption before banning cryptocurrency transactions in 2021. Despite this strict crackdown and the regulations that control the flow of digital assets, China in 2021-2022 alone recorded more than $220 billion USD in digital transactions, and remains the largest market for cryptocurrency in the East. As of March 2023, China is seeing a shift in their economic policy, which has always centered around greater state intervention, into one that has become more focused on technological growth, self-reliance, and further development as a digital economic superpower. What this means for China’s complicated relationship with cryptocurrency is still unclear, but China’s positioning as a major digital asset superpower and the up-and-coming digital yuan in global markets is irrefutable. This case study will focus on digesting the misalignment between government policy and citizen action in previous financial movements in China, and investigate the possibility of converging centralized efforts with real blockchain usage and CBDC adoption moving forward. We will aim to understand digital currencies and blockchain usage as two separate perspectives, given their differing representations in Chinese regulatory policies.

Cryptocurrency in China

In the fall of 2021, the People’s Bank of China issued a document to regulate the speculative risks associated with trading and mining, effectively banning cryptocurrency transactions. They cited the role of digital transactions in growing threats to China’s financial system, and in facilitating financial crime. It is also speculated that another reason for this ban may have been growing fears of capital flight from the country, and wanting to control the outflow of capital that is happening through digital assets. For many in China, Bitcoin allowed investors to sidestep limits and policies regarding the ownership of capital by purchasing foreign assets. In the past, investors would sidestep capital limits through offshore banking and company accounts, whereas Bitcoin simplifies this process significantly through its decentralized nature. Furthermore, China had already been dealing with widespread power outages – as they are still heavily reliant on coal as a resource for energy, despite goals to increase investment in renewable energy, multi-month energy shortages had occurred over the past few years.

The 2021 ban on cryptocurrency is somewhat sequitur following 2017’s ban on cryptocurrency exchange operations within mainland China. That year, though capital flight was not directly mentioned in the policies in 2017, there were disjoint restrictions leveraged on overseas investments simultaneously – in that sense, the 2017 changes in cryptocurrency policy can be seen as the precursor foreshadowing the policies in 2021. The September 2021 crackdown was the final move in a series of reactions throughout the year – from banning crypto services from financial institutions in May, to cracking down on mining of crypto in June, to the full shutdown of transactions in September, the policies they have enacted today aren’t exactly a surprise nor something that no one saw coming. Then, why is cryptocurrency still such a convoluted topic of such relevance within a landscape that is not ambiguous in terms of restrictions and regulations? If China truly felt so hostile towards cryptocurrency, why is it such that China is still a leading power in cryptocurrency mining by volume? Though the immediate aftermath of the crackdown resulted in an 8% drop in activity on the Bitcoin network, there was a surprisingly quick bounceback as Chinese miners either relocated their operations abroad or figured out new ways to establish underground mining hubs. Though the US has remained as the global lead for Bitcoin mining, China has reestablished itself as a mining superpower.

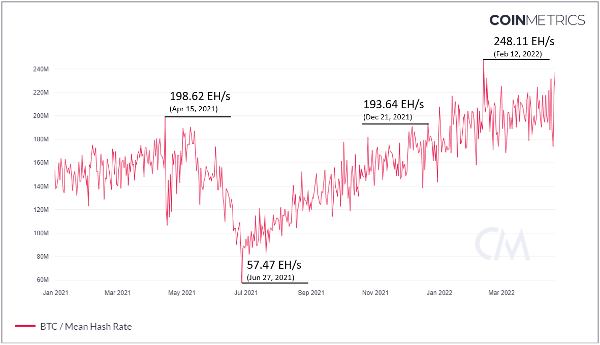

This graph illustrates the hugely noticeable drop in activity when China announced its ban on domestic mining activities. Their crackdown had an immediate effect on the harsh decline of the total hashrate globally, which even bottomed at the end of June. However, by the end of the year, the total network hashrate was close to the level it had been pre-ban. This growth continued into 2022 and hit a record high. The return of China to the second greatest contributor to mining implied that efficient underground mining activity had taken place successfully – through off-grid electricity, and smaller scale operations that were more geographically diverse, underground miners were able to shield their operations from being discovered, effectively avoiding the ban (to the best of their ability).

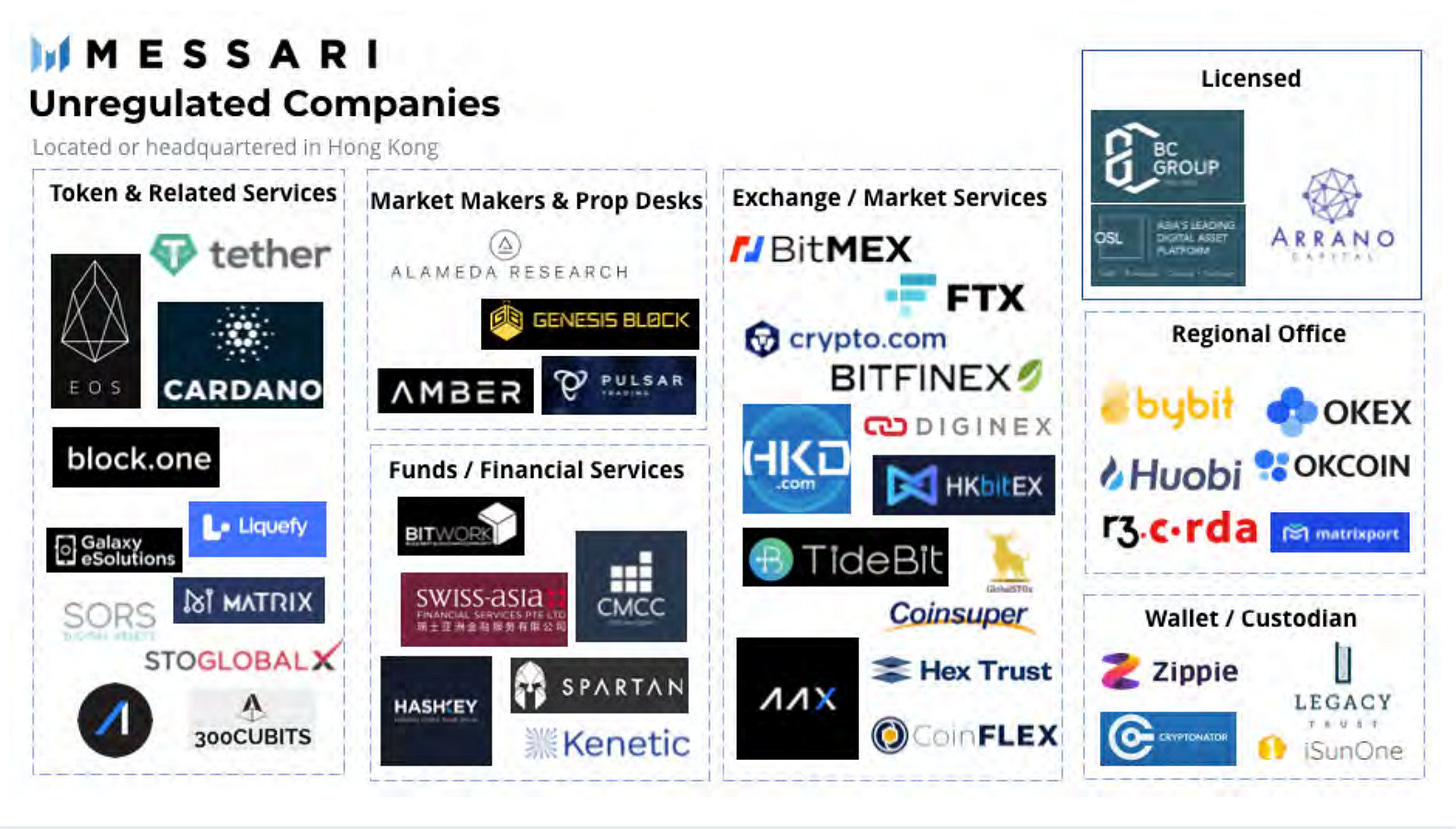

Despite the clear misalignment that exists between the interests of the bank and the people, in terms of the widespread crackdown on crypto activities in all fields, China is shockingly curious about blockchain technologies, and seem to be leading the race in digital currency with their very own CBDC. Their intention to launch CBDC as a globalized digital currency could explain why they are so careful to preserve the energy they have in order to push greater resources into boosting this coin rather than foreign cryptocurrencies, and their interest in exploring the regulatory and financial landscapes of surrounding countries. It might even be plausible to consider Hong Kong as a playground when it comes to cryptocurrency and blockchain – the continued attendance of Chinese government officials at Hong Kong cryptocurrency conferences could even be seen as an implication that China is “soft-backing” the crypto movement through a surrogate economy that they are closely linked to.

Earlier this year, President Xi Jinping expressed concerns that China must work towards addressing technological issues from a basic level, noting that China would need to strengthen basic research in STEM in order to reach a long term goal of self-reliance and an identity as a global tech superpower.

The Central Bank Digital Currency of China

It’s a real and recognized issue that China’s new and emerging cryptocurrency has the future potential to replace the dollar as the medium of exchange for global transactions. China’s lead in a race to develop the next technological revolution, or next global currency, has led to increasing attention on the e-CNY, or what we will refer to as the digital yuan. Though the US dollar is still the most dominant currency in the worldwide market, as the decade continues to unfold, it is clear that this emerging currency has the ability to challenge the financial hegemony that the dollar holds, and perhaps go as far as to unseat it.

China’s renminbi (RMB) is a currency used within the global foreign exchange market, totalling billions of transactions but only making up 2% of all transactions globally in terms of volume. On the other hand, the US dollar makes up 88% of these transactions, bolstering the US to considerable economic and political power. This power is accompanied by a massive amount of benefits in the global economy, ones that China is certainly aware of and highly interested in. China’s push to internationalize the renminbi has been a part of their economic plan for the past few decades now, as the success of these operations could mean that China could have access to many of the same benefits that the US enjoys now. However, a lot of the popular international currencies are largely associated with economies that are known to be open, capitalist, and liberalized. China’s economy is more associated with rule of law, a tight government rein, and trustworthiness, which has made it such that investors are doubtful when it comes to relying on Chinese currency. Beijing’s 13th Five Year Plan that spanned 2016-2022 had voiced a strong desire to internationalize the RMB, as a broad tenet of economic growth.

Beyond their criticisms of the current global financial system and the role of the US dollar in global recessions, there are plentiful benefits that would be associated with reforming the system such that the RMB could be used for trading, lending, borrowing, and investing internationally as a primary form of currency. Not only would it mean that Chinese citizens and investors would experience minimum rate risks in investments and transactions, there would also be a much more minimized reliance on USD and the associated systems and risks of it. Borrowing internationally as well as borrowing at much lower interest rates implies that China would be able to run a government deficit with less burden currently and into the future, as they continue to develop their economy and reach their full potential as a financial superpower.

Escaping USD monetary policy, preventing future dollar shortages, and greater ease of government and investor borrowing means that China is thoroughly incentivized to work towards the globalization of RMB. However, the distrust of foreign economies in the differences in Chinese government intervention associated with the RMB as well as the significant lead of the USD in global economies means that there is no easy path for China to achieve this global dominance.

The digital yuan could be a gamechanger for China’s goals. China began investigating such a currency in 2014, when China’s Bitcoin minings comprised a solid 95% of mining activity. This suspicious use of power intensive mining was discovered and shut down quickly as governments saw such decentralized, anonymous, and unregulated currency as a major threat to China’s historically strict financial controls and limitations on how their citizens could individually participate within the global economy. However, at the same time, they recognized there was immense potential for a digital payment system, one that was government-controlled and tested before release. Early adoption numbers did not look great for the government, as despite the 123 million wallets that were created, the average balance in each came out to an disappointing 47 cents. China was able to hard launch their digital yuan during the 2022 Winter Olympics, when they saw an estimated $300,000 in daily transactions with the digital yuan for the days that the games were occurring. The digital yuan in 2023 sees much more usage and offers an expanded set of capabilities, getting smart contract functionality amongst other new use cases such as buying securities, making offline transactions, and involvements in global trading. However, the government has still admitted that the usage has been lower than what they have expected, and nonoptimal.

Even with these shortcomings in the slow adoption arc of the digital yuan, China is much farther ahead than any other player in the digital currency market. The US began investigating a CBDC only in March 2022, and despite hope in creating a US CBDC that would be much more stable and handle transactions more efficiently, they are still 10 years behind China in terms of development, testing, and launching. In this sense, a financial system dominated by the digital yuan at the forefront of CBDCs and stablecoins is a very possible reality, and one that we could see more and more of this upcoming year.

Blockchain in China

Despite an ongoing and historical crackdown on crypto, China has continued to embrace the mantra of “blockchain, not Bitcoin”, even to the point of launching the National Blockchain Technology Innovation Center in Beijing.

Takeaways

China’s bid to internationalize the RMB drives future international adoption of digital yuan

Despite seemingly wanting to drive a widespread shutdown on cryptocurrency activity and transactions, China actually has a strong vested interest in crypto growth

Manifests in wanting tighter controls on foreign interest, but essentially soft backing crypto through satellite regions and development of digital yuan

“One eye opened, one eye closed” approach

Seemingly draws the line at mining and capital outflow, but allows a lot of development and creation to go on under the radar

Hong Kong Case Study

Hong Kong’s cryptocurrency policy has evolved, particularly over the recent months, from relaxing regulations to launching a campaign to become a global crypto hub.

Background

Beginning in 2018, Hong Kong limited crypto trading to institutional investors, leading digital startups to flee to Singapore and other more lenient jurisdictions. In 2021, the Securities and Futures Commission (SFC) introduced licensing for virtual asset service providers (VASPs), regardless of whether they offered access to tokens considered securities or solely cryptocurrencies.

However, authorities changed course in October of 2022, when a public consultation period was launched to decide whether to allow retail crypto trading and permit crypto exchange traded funds (ETFs). In February 2023, the SFC proposed a licensing regime that would allow retail investors to trade large cap tokens (ie. Bitcoin and Ether) on licensed exchanges. The government also issued 800 million Hong Kong dollars of green bonds as digital tokens––the first of its kind globally. Further, it has dedicated 50 million Hong Kong dollars to developing blockchain companies.

Motivations

The policy reversal can be attributed to Hong Kong’s focus on maintaining its status as an international finance center. Harsh regulations, as well as COVID restrictions and national security laws that eroded Hong Kong’s financial markets, led talent to flee to competing hubs. Hong Kong is now aggressively focused on regaining ground, particularly against Singapore. Taking an opposing stance against Singapore’s tightening regulations has attracted firms back to Hong Kong. Leading digital asset startups are considering moving their headquarters to or expanding in Hong Kong. There is also a noticeable uptick in interest from overseas companies in applying for a VASP license.

Impact

The recent regulatory changes in Hong Kong also highlights a nuisance dynamic with the Chinese government regarding crypto stance.

While adopting a relaxed regulatory environment that stands in stark contrast to mainland China’s hard-line anti-crypto policies, Hong Kong underscores its autonomy from China in financial regulations.

However, Beijing officials are surprisingly not openly opposed to these developments. In fact, officials from the China Liaison Office can frequently be seen at crypto gatherings, partaking in friendly discussions and feedback for projects. Some perceive this as China’s “soft backing” of Hong Kong’s progress towards becoming a crypto hub.

Further, relaxed policies are undoubtedly shaping Hong Kong into a safe haven for Chinese-founded web3 companies in exile. As companies now stream into Hong Kong, it has the potential to become a testing ground for China’s policymakers to see blockchain’s potential without risking directly involvement from the country’s one billion netizens.

Conclusion

Hong Kong’s recent overt embracement of crypto provides a useful case study for how international dynamics are shaping policy changes. Competition with leading financial hubs such as Singapore motivated Hong Kong to launch aggressive encouragement of crypto adoption. This, coupled with China’s curiosity towards Hong Kong developments, demonstrates that though crypto continues to be perceived as a high risk market, its potential to drive real economic growth is in fact being explored.

Singapore Case Study

The stance on cryptocurrency in Singapore is contradictory: they aim to become a cryptocurrency hub, yet have indicated hostility towards digital currencies and transactions, citing volatility and security issues.

Introduction and Market Overview

The Singaporean authorities take a pragmatic and tailored approach when it comes to digital currencies. Despite a global slowdown of investment in cryptocurrencies following the second half of 2022, when investors digested the rapid and consequential falls of Terra, Three Arrows Capital, and FTX, cryptocurrency and blockchain technologies remained the top area of financial technology investment in Singapore in 2022. In recent years, Singapore has strived to become a global hub for cryptocurrency, yet have loose and contradictory reactions towards digital currencies and transactions. Still, they have shown their approval on blockchain technology in the past and have leveraged various projects, such as Project Ubin and Project Guardian. The Singaporean blockchain market has the potential to reach a range of market spending between $1.9B and $2.6B by 2030, since 2013, the Monetary Authority of Singapore (MAS) has cautioned consumers against the significant risks associated with digital transactions. Their most recent consultation period in December 2022 outlines a series of regulations that aim to protect retail customers and ensure stability in the digital payment market through cutting down on leveraged transactions and mandating base capitalization and other risk-regulating activities. In this case study, we will dive into the conditions surrounding their recent crackdown on the industry following landmark moments for the market in the past year, and the growing hostility the city-state has developed towards the space.

Government Backed Collaborations

Product Ubin

Project Dunbar

Project Orchird

Project Guardian

Regulatory Proposals

Regulation of cryptocurrencies in Singapore has seen significant developments over the past decade.The Monetary Authority of Singapore (MAS) have cited volatility and security concerns towards virtual currency transactions even since the space first saw notable growth in 2013. During the 2016 explosion of ICOs, MAS clarified existing securities laws and advised consumers to exercise due diligence when engaging with digital tokens. However, they stated that they would not explicitly regulate virtual currencies, despite encouraging extreme caution in consumers and investors. They would hold on to this perspective until January 2022, when they introduced the first wave of regulation on cryptocurrency marketing and advertising of trading aimed at limiting downside. The major landmark events of last year, such as the collapse of FTX, the downfall of other major players, and the implosion of leading firms registered in Singapore, called to place the release of proposed measures to reduce the risk of consumer consequences. Proposed changes would include restrictions on credit card payments. financing plans, and incentives for trading, and hold foundations accountable for the segregation of customer assets from business assets as well as the lending of assets that are technically owned by retail consumers. These changes represent a stark contrast to the relatively relaxed approach Singaporean based cryptocurrency or blockchain companies enjoyed for the past decade, in response to devastating accounts of retail investors who have lost life savings and fortunes to the trading space.

Going Forward

MAS will be following up with two new industry pilots — one with Standard Chartered Bank leading an initiative to explore the issuance of tokens linked to trade finance assets and the other with HSBC and UOB working alongside Marketnode to enable native digital issuance of wealth management products.

Conclusions

As a top financial center globally, Singapore has taken one of the most conscious and intricate approaches to dealing with the boom of cryptocurrency and blockchain business – simultaneously creating a welcoming and conducive space for new foundations to develop while keeping a consumer-centric and strict hold on the transactions that are taking place.

India Case Study

India’s perception towards crypto has shifted dramatically in the recent years, from allowing a period of free reign usage between 2020 to 2022, to taking a maximalist stance in regulating crypto.

Background

In 2018, the Reserve Bank of India (RBI) issued a circula that restricted banks and other payment systems from transacting with virtual currencies, crippling the nascent cryptocurrency sector in India. Trade volues plummeted and exchanges shut down their businesses, and a two-year legal battle ensued. In 2020, the ban was struck down in by the Supreme Court, causing a surge in investments in the sector. The India government began demonstrating interest in exploring blockchain applications, releasing a draft discussion paper through the National Institution for Transforming India (NITI Aayog) in January 2020. The paper explored use cases such as systems to manage land record transfer and ownership, blockchain enabled trust in pharmaceutical drugs supply chain, and anti-fraud identity solutions for educational certificates. Overall, it promoted research and development of blockchain solutions to build towards India as a blockchain hub. Practical recommendations even extended to launching an IndiaChain, a national infrastructure for deployment of blockchain solutions, a pegged stablecoin for the Indian Rupee, and creation of an ICO market in India.

Regulations

Sentiments around crypto in India took a drastic turn in 2022 following broader market crashes. Since taking over the G-20 presidency in March 2022, India has made regulating crypto assets a priority in the group’s agenda, with the goal of creating a global Standard Operating Procedure (SOP). It is seeking global consensus on regulating and even banning currencies, given crypto’s borderless nature, which recently gained support from the United States and the International Monetary Fund.

The country also took on a “tax them to death” attitude, implementing a 30% tax on crypto profits on top of a 1% tax on all digital asset transfers above RS50,000, deductible at time of transaction. The slew of harsh taxes drove rapid decline in trading volume from India across major cryptocurrency exchanges, from -70% within 10 days to -90% in the next three months. Crypto traders moved to offshore exchanges and projects moved outside of India.

In March 2023, the Ministry of Finance imposes anti-money laundering provisions on crypto sector, with crypto exchanges, NFT providers, and custody wallet operators responsible for monitoring suspicious financial activities. The Enforcement Directorate has begun investigating projects for money-launder schemes, having seized $115.5M to date.

Though the RBI has recommended a complete ban on cryptocurrencies such as bitcoin and ETH, viewing them as a threat to RBI’s authority, the government has clearly stated its intent to regulate, not outright ban crypto in the country.

Conclusion

Compared to its regional peers, India has taken a strikingly hostile stance against crypto, from enforcing harsh taxes on all transactions to provisioning the sector with anti-money laundering measures. Most notably, its pursuit of a global regulation framework for crypto will be a worthy case study in collaborative international policy moving forward.

Philippines Case Study

While crypto adoption has been particularly visible in the Philippines, the country’s crypto-friendliness is not immune to recent market crashes as seen in subsequent regulatory efforts.

Background

Historically, the Philippines has led in retail adoption of crypto (second only to Vietnam), with a penetration of 15%. In the first half of 2021, crypto transactions in the country saw a spike of 362%. As of 2022, 2% of all known transactions in the Philippines were done in crypto. Adoption is well distributed amongst age groups: 43% of crypto owners are 18-34 years old, 35% are 35-54 years old, and 22% are 55+.

Catalysts to Adoption

Cryptocurrency has been legal in the Philippines since June 2017, when Circular No.944 established guidelines for virtual currency exchanges. As a developing economy with consistent inflationary pressures on the peso, crypto is commonly used for remittances and payment. Projects such as Coins.ph, Rebit.ph, and Bitmarket.ph have played a significant role in Philippines’ financial revolution in recent years. For the large unbanked (53%) and underbanked population in the Philippines, crypto is appreciated for its security, low transaction fees, and fast transaction times.

Further, the government itself has demonstrated increasing intent in developing blockchain use cases in the country, such as initiating a pilot project on issuing CBDC. In addition, it is actively implementing blockchain training programs within agencies such as the Department of Science and Technology.

Hurdles to Adoption

With recent market crashes and many investors losing large amounts of wealth, regulators have begun seeking stricter guidelines for crypto activity in the country.

In August 2022, the central bank announced a three year break from accepting new virtual asset service provider applications, with plans to reopen in September 2025. In January of 2023, draft rules were published under a broader consumer protection law to give the Philippines SEC greater authority over the industry. The draft defined financial products using blockchain as securities, and gives the SEC the ability to restrict service providers from collecting excessive fees, disqualify executives and employees violating the laws, and even shut down an entire firm’s operations.

Conclusion

The Philippines’ large unbanked population provides fertile ground for crypto adoption in the country. We’ve seen many countries with weak currencies turn to crypto. The government’s active exploration of blockchain technology through experiments such as CBDC, coupled with recent regulatory steps, highlights an attempt to maintain a delicate balance between pushing financial innovation with risk management.

Discussion and Key Takeaways

Differentiating Between Eastern and Western Approaches to Regulation

Regulatory sandboxes are used as a common approach in the East, which isn’t common in the West

Markets are first given free reign to develop, then regulatory policy is developed based on the trial.

The transplantation of regulations from country to country

Hong Kong has historically been responsive to American/British laws, but on a lesser scale.

Regulatory landscapes in Asia are tightening, but slower than the Americas and Europe.

Clear-cut licensing regimes in the East compared to regulatory ambiguity in the United States

Hong Kong, Philippines, Singapore have established Virtual Asset Service Provider licensing legalizing cryptocurrency while restricting enabling platforms with well defined guidelines.

The United States has historically struggled in defining not just what policies to promote, but also the goals of those policies in attempting to balance encouraging the growth of a lucrative industry with policing illegal cybercrimes.

Citizen centric in the East vs legality centric approaches taken in the West

Eastern regulations are largely driven by consumer protection concerns

Western regulations have historically focused on controlling cybercrime

Cautious Approaches and Ambiguous Perspectives

Regulatory changes were largely a reaction to 2022 market crashes

Singapore investors affected drove tightened legislation plans

India’s “tax them to death” approach, anti-money laundering provisions, and efforts to urge a Global Standard Operating procedure for internationally collaborative regulatory policy.

Philippines’ break from accepting new VASP applications, and defining blockchain products as securities subject to SEC scrutiny.

It seems clear that more larger scale collapses or rugpulls will likely lead to tighter regulations

Satellite curiosity in cryptocurrencies

China’s “soft backing” of Hong Kong’s growing crypto hub––is HK a testing ground for China’s blockchain/crypto rollout?

China’s “one eye opened, one eye closed” approach to restricting crypto transactions and mining

If their aim is to comprehensively restrict crypto activity in the country, why is there still so much under the radar activity?

Brewing ambitions from historically fintech forward countries to become crypto hubs

Somewhat contrasting approaches in Hong Kong vs. Singapore––HK’s complete embracement, Singapore’s more cautious approach

How the East is Embracing Blockchain Adoption

Blockchain, not bitcoin: government incubation of blockchain applications

Regulations largely center around crypto transactions, while curiosity about blockchain use cases drove direct government-led experimentation

Government sanctioned blockchain projects include

Hong Kong’s digitized green bonds and crypto futures ETFs

India’s NITI discussion paper

Beijing’s blockchain technology hub sponsoring blockchain projects

Exploring central bank digital currencies and piloting programs

CBDC presence in China, Philippines (CBDCPh), India (CBDC-R, CBDC-W), Singapore (Project Ubin), Hong Kong (Project Aurum)

Despite diverge takes on blockchain regulation, we see continued efforts from most countries to be at the forefront of continued innovation

Further Points of Discussion

We believe that the overall Web3 ecosystem could benefit from greater discussion and collaboration surrounding these following topics, in terms of growing in a direction that allows more scope, global participation, and financial equity in all sorts of economies.

How changing regulatory landscapes in the West could mean increased operations in Asia, and how this might be a part of a causal relationship in regulatory actions there

How to establish causation between changing regulations in the West and in the East → how can we see the effects of legislative adoption on movements in other regions to keep track of where the ecosystem is expanding into?

How the implications of regulatory landscape changes in Asia may influence how the West intends to regulate cryptocurrency

How cross-border regimes for regulation and development might impact the future of Web3 and globalization

How the global economy will be affected by the growing leverage of central bank digital currencies

Conclusion

At the macro level, when considering global blockchain and cryptocurrency adoption, there are some critical differentiations to draw in the path to adoption between Eastern and Western countries.

There’s some common misconceptions regarding Web3 in Asia that are the result of overgeneralization or projection, especially when conflating the interests of governments and the citizens that they represent. Misalignment can be seen in China, where the government has voiced strong opposition (an outright ban) to the mining of cryptocurrency, yet China still holds a huge proportion of mining activity globally. Especially when regarding strong government control in currencies and economy, cryptocurrencies that are associated with unregulated third parties manifest as a huge threat. Thus, it appears such that China has been particularly aggressive in regulating cryptocurrencies – it’s important, then, to consider the narrative less as that China is “anti-crypto”, or opposes blockchain technologies. Their support of blockchain technologies is in fact often overlooked. Finding the political context of their ban can help to break down some of the overly simplified misconceptions regarding Asian attitudes towards blockchain – for China, their ban is largely reflective of their government ambitions as well as their political fears. Their anxiety towards capital flight and simultaneous aggressive push for leveraging the yuan in global markets is what drives their stance on cryptocurrency, and it’s not as aggressively anti-crypto as anticipated when considered in that way.

The context of regulation in Asia has to also take into consideration the high volumes of backing that cryptocurrencies and blockchains receive from Asian investors, and how these volumes are only getting larger as regulations continue to change around the world. Understanding regulation in an Eastern context is vital to understanding making the industry viable in the long run – which, for Asian regions such as Hong Kong and Singapore, who have stated plans to become hubs for cryptocurrency and blockchain, explains a lot of their newly restrictive attitudes towards cryptocurrency. These governments want to protect their traditional financial industry players, who are likely feeling pressure from the cryptocurrency market, as well as protect their consumers, creating restrictions that will weed out risky or bad actors in the market before they have extensive access to billions and trillions in users’ funds.

This consumer centered approach can be seen in a lot of Asian regulations towards cryptocurrency. In China, it can be considered as part of the “common prosperity” campaign, in which social equality and economic equity is bolstered through limiting access to excessive capital and protecting investors/consumers from risky deals that might allow capital to escape the government’s control. Similarly, Singapore has a vested interest in the investors that drive its global hub of innovation, and would want to protect their prosperity even at the possible expense of quick breakthroughs and technological movements being built ground up in Singapore. Still, it’s reflective of government ambitions – Singapore wants to create sustainability in the industry such that it can reach its goal of becoming a global fintech hub, and though its new policies seem strict and unforgiving, it makes a lot of sense in the long term. Their appetite for cryptocurrency is overall dependent on the perceived risk towards the investors that keep their economy running. Hence, it’s clear that governments have to take more and more protective policies in response to the collapse of projects within their space and the aftershocks of such events.

We also examine whether the East takes a more or less cautionary approach as compared to the West. We can take the U.S. and South Korea, both of which started forming regulation authority around the 2017 ICO boom. However, since South Korea has such established digital infrastructure, there was a considerably higher amount of activity coming out of South Korea – at some point, Bitcoin and Eth were trading in South Korean exchanges at a 30% premium above Western parallels. In response, instead of clamping down like the SEC did, South Korea had to take a more cautious approach in terms of regulating without causing massive political disturbance. Sure, they could really attack these exchanges to relieve some of the potential risks that investors are taking on, but isn’t there some curiosity to be explored in terms of all the high demand surrounding cryptocurrency?

Thus, it’s hard to say whether the East uses more or less caution compared to the West. In a similar way, both are focused on consumer protection but in a way that seems to be much more investor and user centric in the East than in the West, where regulations are largely focused on policing criminal activities leveraging cryptocurrencies. In contrast, there is less caution in terms of what some governments in the East are willing to allow in order to fulfill goals of incubating innovation in a growing and potentially lucrative market. The United States, for one, is less open to allowing companies free reign to develop and raise capital, even given the alternative of missing out on potential breakthroughs. However, an important contrast is the clarity that exists within the regulations developed in Asian countries compared with the more ambiguous, overreaching regulations in the West. As a result of being more open to regulatory sandboxes and incubation, Asian countries are often more able to develop specific, clear-cut policies on different aspects of Web3 in comparison to the West, where things get a little more muddled and there is less division and more generalization.

All of the misconceptions towards blockchain and cryptocurrency presence in Asia points to a larger, more prevalent misunderstanding of the massive role that Eastern economies and investors play in the development and incubation of Web3 technologies. As such, it is important that the ecosystem as a whole works to take steps forward in fostering a more inclusive environment for different governments and ecosystems to have voices in the community. There needs to be more credit given for the huge contributions that Eastern regulations and regions have provided towards the growth of the industry, and recognition in the future as protocols become more internationalized and integrated within the global economy. As such, there also needs to be greater collaboration between the cryptocurrency community and regulators in building legal frameworks that enable freedom to operate while also attracting safer, broader investment.

All of these goals hinge on achieving adoption through a consumer-centric approach. In many ways, the West can take lessons from the East in terms of approaching future legislative battles relevant to the industry. The integration of the global economy in leveraging both Western and Eastern roles and markets in the continued growth of technology and innovation in the Web3 space would be one massive leap in the quest for mainstream mass adoption.