The need for scalability – Introduction

With a market price of over $200 billion, Ethereum has quickly become the most well-known blockchain in the cryptocurrency ecosystem.1 Decentralized apps, or dApps, are created on top of it and increase yearly. Unfortunately, the platform was unprepared for such a dramatic increase in activity, and its impressive scale introduces problems with transaction speeds and costs. Ethereum was never designed to facilitate thousands of transactions per second (TPS) and is now suffering from its success, as fees on a single transaction can reach above $10. The scalability problem is currently being solved by scaling solutions that in some way interact with Ethereum’s underlying infrastructure to increase its transaction speeds and decrease fees. Currently, two of the most prominent scaling solutions are Arbitrum and Polygon.

Polygon and Arbitrum are Currently Dominating the Battle for Ethereum Network’s Scaling

The Layer 2 scaling solution Polygon (previously Matic Network) works in tandem with Ethereum to facilitate the creation and connection of networks that are compatible with Ethereum. Recently renamed from MATIC, Polygon is a widely used layer-2 solution for Ethereum that uses the decentralised ledger notion of sidechains. It employs a consensus technique based on proof-of-stake, which results in much cheaper gas expenses and maximum transaction throughput of 65,000 per second. New York-based startup Off-chain Labs created the layer-2 feature known as the Arbitrum network to enhance the validation of smart contracts and alleviate the congestion that has plagued the Ethereum network. The architecture uses the Ethereum mainnet's security while letting smart contracts operate on a separate layer to lessen network congestion. Despite being a Layer 2 solution, Polygon is technically a sidechain. Hence it is essential to distinguish it from alternatives like Arbitrum and Optimism. In contrast to side chains, which rely on their own consensus methods, the Ethereum platform provides complete security for Layer 2 solutions. In this sense, sidechains are decentralized, EVM-compatible alternatives to the mainnet.

Junkie’s Introduction to Polygon and Arbitrum – Areas of Clash

Polygon is a sidechain, while Arbitrum is a rollup. That means Polygon is a separate chain connected to Ethereum by a “bridge” that enables tokens to be transferred from one network to another. At the same time, Arbitrum is a part of the Ethereum chain, which computes the transactions outside of the chain, and sends the resultant state of the network back to the base layer.2 The setup has implications for the three fundamental aspects of a blockchain network: speed, security, and decentralisation. All three are essential to a network's value proposition because they impact the scaling solution's success. We posit that the three most important determinants of a network’s usage future usage are its user experience, the scaling infrastructure, and the security. The quality of the network’s value proposition in these three areas is the function of the validity of the platform’s vision and its ability to execute on the vision.

History

The network’s history is crucial to understand its vision.

Arbitrum’s History

Abitrum was launched in 2021 by Offchain Labs. The pace of adoption by the Ethereum community is incredibly quick. The number of active users on Arbitrum soared from roughly 25,000 last year to almost 260,000 this year. On the other hand, Polygon’s number of users has only grown by 50% in the past year, reflecting a slower pace of adoption.3

How did Arbitrum scale so quickly? Because it delivers to the users exactly what they desire. Unlike Polygon, which, as a side chain, to a large degree, tries to supplant Ethereum, Arbitrum’s vision is to augment Ethereum.

Polygon’s History

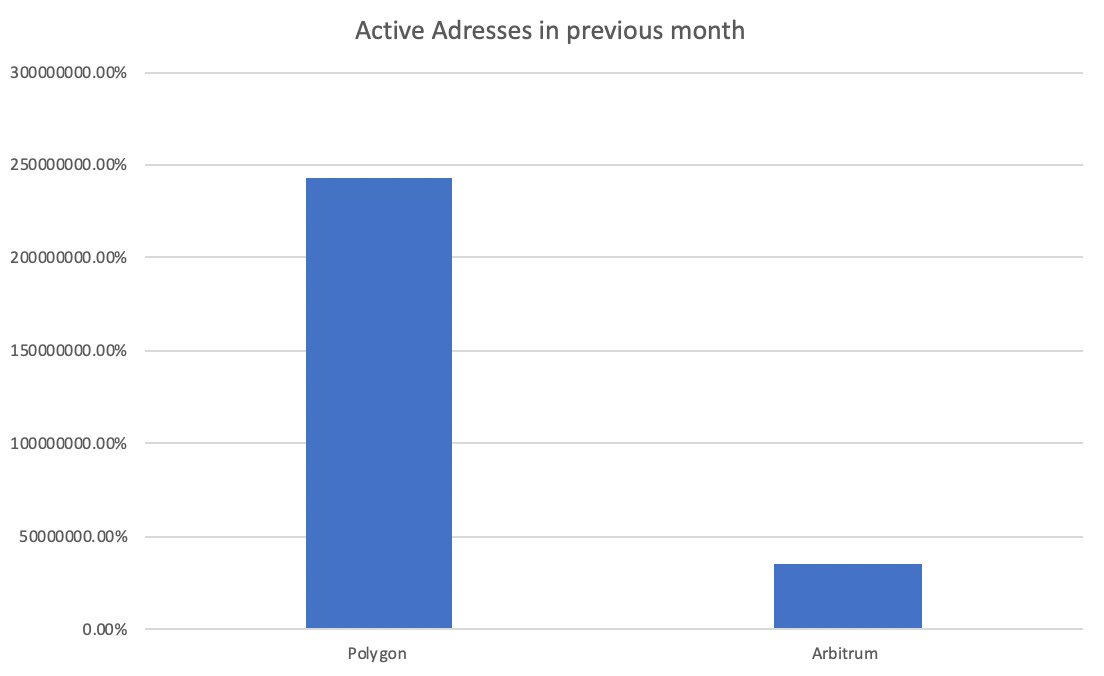

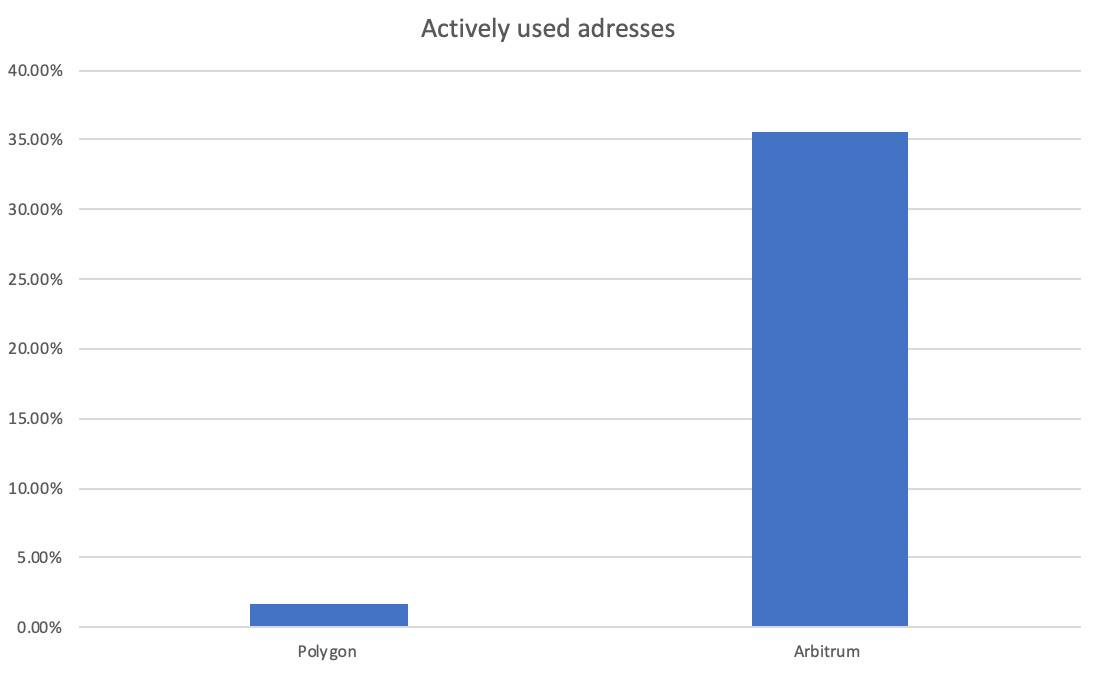

In terms of widespread use, Polygon easily beats out Arbitrum. Over the last month (6/26-7/26/22), Polygon averaged over 2.7 million daily transactions, whereas Arbitrum averaged slightly over 100,000 transactions. (Figure 1) In addition, Polygon has around 150 million unique addresses, whereas Arbitrum only has about a million. (Figure 2) Active unique addresses provide a more reliable distinction, albeit this statistic may be deceptive. In terms of the number of active unique addresses during the previous 30 days, Polygon has 2.43 million, and Arbitrum has 355 thousand. (Figure 3) Thus, the difference narrows marginally. It's interesting to see that although 35.5% of Arbitrum addresses are actively used, just 1.625% of Polygon addresses are. (Figure 4) Those who utilise Arbitrum as a "bridge" to get their money elsewhere tend to stick around. Because of its lower gas fees, Polygon has a higher number of unique addresses because it is a simpler entry-level solution. Polygon's ecosystem is far broader and more diversified than any competitor's, even though user retention rates are lower.

Vision - The network’s vision

Arbitrum’s Vision

Arbitrum realises that the primary advantage of Ethereum is its best-in-class security and its DeFi ecosystem. Its scaling plan is to retain as much security as possible. This allows it to offer better security than other scaling solutions, with an “in-house” security layer. Moreover, Arbitrum attempts to augment the DeFi and NFT ecosystem with unique applications, faster transactions, and lower fees.4

The vision of security and user experience flow into what Arbitrum is trying to achieve as a platform: to propel Ethereum’s adoption by offering an improved value proposition to the user through speeding up the base network and minimising the costs. Arbitrum realises that the roadblock to Ethereum’s adoption is speed and cost, roadblocks that Arbitrum removes.

The alignment of Arbitrum’s vision with users and laser focus on DeFi and NFTs positions Arbitrum well to capture an outsized portion of the future adoption of scaling solutions. Its ecosystem, user experience, infrastructure, and security enable it to capitalise on that opportunity.

Polygon’s Vision

Recognizing the future of Ethereum, Polygon’s mission is to scale Ethereum in the fastest and most secure way possible. To attain this, a large part of what Polygon does is provide an accelerant for dApps to be created. As such, they allow dApps to be created faster, safer and with very low gas fees. To do so, Polygon intensively supports developers through its programs.

Polygon was the first ever easily accessible Ethereum scaling and infrastructure development platform. At the core of all its offerings lies Polygon SDK. Polygon SDK is the core framework that supports developers to build all types of applications on top of Ethereum. Using polygon, developers can now easily create Optimistic Rollup chains, ZK Rollup chains, stand-alone chains and many more.

Polygon is continually working on new features and improving its current technology to cater to the more diverse needs of developers. Polygon hopes to ease the bottleneck of transactions on the Ethereum network by continually working on its technology and continually offering more rollups. In doing so, Polygon hopes to dramatically increase the speed of blockchain transactions and dramatically lower fees for making these transactions. Polygon’s MATIC token is also a core part of its ecosystem. The MATIC token will become increasingly important in securing the polygon network and enabling a decentralised governance experience.

Current scaling solutions being worked on by polygon:

These will be discussed in more detail later in the article.

User Onboarding

To be successful, a scaling solution needs a frictionless way to onboard its users.

Arbitrum’s User Onboarding

Arbitrum’s approach to onboarding is to onboard users on the Ethereum network rather than onboarding non-crypto users directly to a scaling solution. Though not stated directly, one can glean that from the necessity to use Ethereum on Arbitrum’s platform. That is important. Any scaling solution that does the latter is at a disadvantage. The preferred way for new users to tap into a scaling solution is through layer 1. The alternative is to use a fiat on-ramp with high fees and long processing times or withdraw tokens from CEX to the chain. Though withdrawing tokens from the chain is a suitable alternative to bridging from L1, most new users will be acquainted with the L1 because of its better name recognition. By targeting users that are on L1 instead of trying to onboard users directly, Arbitrum does not have to compete with Ethereum’s name brand in the battle for how users access blockchain in their first interaction. Thus, Arbitrum’s approach is better suited to capture scaling solutions users, given users' proclivity to try scaling solutions after they try Ethereum.

Moreover, the new user experience on Arbitrum is better than that on Polygon. Polygon’s choice to have its native token obfuscates this process. If a user, as in most cases, accesses the scaling solution through L1, he must swap some of his funds for MATIC and bridge MATIC to Polygon. Alternatively, he can bridge his tokens to Polygon and convert them to MATIC within his wallet, gas-free. Though the second approach is relatively hassle-free, it still posits one more friction step than the Arbitrum experience, which only requires a user to bridge his Ethereum to the Arbitrum.

Polygon’s User Onboarding

Polygon has historically been known to be quite acquisitive, using its reserves to invest in several strategic projects. In particular, Polygon has been focusing on developing its zk-rollup technology and EVM equivalent zk-rollup technology. Apart from attracting new users through their technology, Polygon is building up an immense portfolio of dApps. They place a lot of emphasis on helping developers create their dApps, louring them to the Polygon network.

Polygon has positioned itself as the go-to blockchain partner for traditional businesses. They have been building partnerships with high-profile brands such as working with Mercedes-Benz on a data-sharing platform, the NFL on NFTs, Stripe for payments, Meta for NFTs and many more. All these companies will bring massive amounts of users, and Polygon hopes to piggyback off of their successes. One noteworthy example is Starbucks: Polygon hopes to move Starbucks’s loyalty program on the chain bringing 27 million reward members and over $1.7 billion in rewards credit.5

Polygon also sees a significant opportunity within the web3 gaming industry. Polygon Studios, which will be discussed in more detail later in the article, hopes to attract users from the massive traditional gaming industry.

Finally, Polygon is the most active L2 solution in terms of business development. They have roughly 40000 dApps to this date on the PoS chain alone. With the extensive selection of dApps, the Polygon community will continually grow to adopt them, which should help Polygon grow.

Existing User Experience

Merely speeding up the network doesn’t differentiate a scaling solution from the others. Hence, though Arbitrum and Polygon’s end goal is to augment Ethereum, it must present users with a differentiated value proposition. Regarding existing user experience, they do this in three areas: the application ecosystem, market sentiment, and privacy features. The number of unique applications dictates how differentiated the users' experience can be. The market sentiment draws users to the network as they get to reap the benefits of price appreciation. Last but not least, privacy is a cornerstone of any blockchain. Bolstering has the same end effect of drawing users to the network.

Application Ecosystem

Arbitrum Application Ecosystem

Arbitrum boasts a more extensive suite of unique applications. The most famous example is undoubtedly GMX, which allows users to trade spot and perpetual futures with a low swap fee of 0.1% per trade, up to 30x leverage for trading, a zero-price impact trades.6 These qualities make GMX one of the favoured decentralised exchanges and present a clear reason for why a user should choose Arbitrum rather than Polygon.

GMX is not a lone project. Other unique projects launched on Arbitrum include Dopex, Radiant, and Umami finance. Dopex is an options platform offering retail investors capital-efficient exposure to options through pools. Radiant plans to become an Omni-chain money market, seamlessly lending and borrowing on multiple chains. Umami generates delta-neutral income for its stakers in the Arbitrum DeFi ecosystem. Though most of Arbitrum native projects are DeFi and NFT protocols, that is because DeFi and NFTs have been Arbitrum’s focus. Offchain labs have started to develop Nova, a blockchain specialised in gaming and social media Dapps, which should provide the Arbitrum ecosystem with a more diverse user experience.7

Arbitrum’s value proposition should keep new projects launching on its network. One advantage Arbitrum has that is especially important for developers is its more expansive offering of supported languages. In addition to Solidity and Vyper, supported by Polygon, Arbitrum’s EVM supports all EVM programming languages.8 The support for all EVM languages broadens the developer base that can develop on Arbitrum.

These factors have contributed to the rapid pace of new contract creation on Arbitrum. The number of Arbitrum contracts rose from 13,000 to 120,000 in the last half a year.9 In the same period, Polygon added 40,000 contracts, bringing its total to 122,000. Arbitrum’s faster pace of development could ultimately create a network advantage for the network, as users will gravitate to the most voluminous ecosystem, with developers launching on the most popular chains, ceteris paribus.

Now, Polygon also boasts an extensive suite of applications. Most of the leading decentralised applications, such as Uniswap, Sushiswap, or Aave, can be used on the Polygon network. Nevertheless, these applications are not native to Polygon. They are merely forks of those already existing on the Ethereum network. Thus, they provide no added value to the user. The largest Polygon unique application is Quickswap which only has a $161M value locked compared to GMX’s $420M.1011 The GMX competitor on Polygon, GNS, currently has 1/9 of GMX traders.12 That makes the platform much less useful, given that traders rely on the leverage provided by other users. GNS also charges a spread ranging from 0.05% to 0.14%.13 The scale of Arbitrum’s largest decentralised applications, which are integrated exclusively into the Arbitrum network, creates a differential in the ecosystem’s quality.

Polygon’s Application Ecosystem

Polygon's DeFi ecosystem is larger at $2.22b in TVL compared to Arbitrum's $1.29b. Polygon has 277 Defi dApps, whereas Arbitrum only has 106. On the other hand, size is not always indicative of quality. Dopex, Radiant, and Umami Finance are just a few examples of native applications on Arbitrum that are debuting with new, innovative dApp features. Polygon, on the other hand, has become a major player in the under-collateralized lending market because of the success of its Clearpool and Teller procedures. Given that both DeFi and Fiat have thriving ecosystems with new dApps being produced daily, it would be silly to proclaim a winner. Polygon rapidly grows into gaming and social media, whereas Arbitrum focuses mostly on DeFi. Polygon scored a huge victory with the release of AAVE's Lens Protocol.

Furthermore, Polygon is leading the pack with some of the most successful projects out there. This is what makes Polygon stand out from the rest of the major scaling and infrastructure development solutions. Polygon is the first L2 solution with an actual native token, MATIC. Why does that matter? you can stake it to help secure the network while enjoying access to the network, its low fees and being eligible for airdrops in the future. Most of the dApps you get access to with polygon are available on Polygon and other chains aswell. But with polygon, you get extremely low fees and very high speeds.

For example, here is a quick introduction to some of the polygon projects:

Jelly Swap: Decentralized Cross-Chain atomic swap service - allowing you to trade your crypto assets across different L1 chains very quickly and very cheaply.

Quick Swap: Decentralized Exchange - fork of Uniswap, which has an additional ERC-2o token bridge, allowing you to bridge your tokens to the polygon network to enjoy low transaction fees.

Mai Finance - Allowing you to borrow money and pay it back minus interest.

Decentral Games: Games - Free to play to earn games

These are only a few of the projects available on Polygon, but there are countless others. Such an extensive list of dApps doesn't exist on the Arbitrum network. In addition to the existing projects, Polygon is also working on rolling out new programs tailored to its customer segments.

Polygon Nightfall

Polygon Nightfall is a specific program targeted to meet the needs of enterprises. ZK Rollups keeps all transactions on the Polygon network private. Optimistic rollups offer an efficient alternative to extremely scalable solutions. Nightfall is secured by Ethereum and is open for whichever business wants to use it. It ensures trust, transparency and credibility. Polygon Nightfall unlocks the true potential of Enterprise blockchains and encourages businesses to scale in unimaginable new ways. Business development is a big priority for Polygon. This is why it is the most popular network that dApps choose. Polygon nightfall is an optimistic rollup designed to lower the cost of privately transferring ERC20, ERC721 and ERC1155 tokens. This solution reduces costs and maintains privacy by using ZK proofs. Ernst & Young (EY) partnered up with Polygon to build Nightfall. This project will provide much more accessibility for any company using Ethereum.

Polygon Studios

Polygon Studios already has over 300 games on its platform. This team is working closely with leading game development studios to tackle tokenomics and NFT ownership in a frictionless way. Comparatively, Arbitrum has no focus on GameFi. So, it is clear how much more diversified Polygon’s interests are.

Polygon Hermez

Polygon Hermez is an EVM-equivalent zk-rollup. this project alone should be able to handle an additional 2k TPS in comparison to only roughly 30 TPS on the current PoS chain.14 For this project, sequencers will have to pay a fee using MATIC to propose a batch. zk-SNARKs will be used to speed up computation in verification.

These are just a few examples of the products in Polygon’s portfolio. For a more detailed overview, check out Polygon’s Solutions.

Price Momentum

One aspect that affects adoption yet is unrelated to the networks’ fundamentals is the price momentum. Price appreciation of a network’s tokens is an important consideration, given that much of crypto is momentum driven. The price momentum could compound in Arbitrum’s favour. When interacting with applications on a network, users will often buy the applications’ tokens, benefiting them from any price increase.

Arbitrum’s Price Momentum

Arbitrum does not have its own token. However, the GMX token, which is the dominant Arbitrum-native token by market capitalisation, has more than doubled since January 2022, despite the overall crypto market losing around 70% of its market capitalisation.1516

MATIC’s Price Momentum

MATIC is currently trading at roughly 490 P/S, this is in line with the rest of the L1 space but it compares well to Ethereum at roughly 170 P/S, indicating that investors are willing to pay a premium for MATIC based on expectations of future fundamentals.

Very recently, the StarkNet Token (STRK) was launched. This and, hopefully, similar events for L2’s doing the same in the future will lead to positive sentiment for zk-rollups. That bodes well for the soon launch of Polygon Hermez on mainnet, which could bring additional momentum to MATIC.

User Momentum

Arbitrum’s easy onboarding, unique application ecosystem, and privacy features help it outperform Polygon in the churn rate of the networks’ accounts and the networks’ user growth. Only 2% of Polygon’s total addresses are currently active, but more than 30% of Arbitrum’s are. However, that 2% on Polygon still represents a larger user group than 30% on Arbitrum. In the last half a year, Arbitrum has been adding around 200,000 users a month, tripling its total user count from 600,000 to 1,800,000 in the past half a year.17 Moreover, its number of daily active users quadrupled from 17,000 to 60,000. In the same time period, Polygon’s number has stagnated between 300,000 and 400,000.18

Security

As with all things blockchain, security is the fundamental building block of a network. Though tradeoffs can be made, they cannot be overt if a network hopes to retain its users. The basic aspects of security are the validation/consensus mechanism, reliance on multi-sigs, and privacy.

Consensus Mechanisms

Arbitrum’s Optimistic Validation Mechanism

Secondly, Arbitrum’s method of validating transactions and verifying fraud is aligned with the vision to speed up Ethereum as much as possible with minimal security sacrifices. Arbitrum integrates Ethereum validators by verifying transactions through an optimistic design, assuming transactions are correct unless an Arbitrum validator flags them as wrong. A validator has seven years to flag a transaction as incorrect, providing ample window to detect faulty transactions. Optimistic fraud detection is one of the most frictionless solutions, not leading to any dispute unless one of the validators sees an issue. Despite minimal friction, the mechanism retains most of the security since there needs to be only one “honest” validator that flags a transaction.

The optimistic validating mechanism enables Arbitrum to leverage Ethereum’s best-in-class security layer without any security leakages. Once a single validator flags the validation as incorrect, the transactions are sent to Ethereum validators, who verify the transactions. Thus, given that there exists one “honest” validator, Arbitrum is just as secure as Ethereum.

Ethereum validators currently stake over $20 billion of tokens to verify the transactions.19 Polygon does not have this advantage. Being a sidechain, Polygon’s security relies on its own set of validators which numbers only 100. Those currently stake around $3B of Polygon’s token.20 The smaller pool of staked tokens present a serious security risk for Polygon. Given that security is one of the most important features of any blockchain, the better security proposition will help Arbitrum attract developers, who look for security comparable to Ethereum’s.

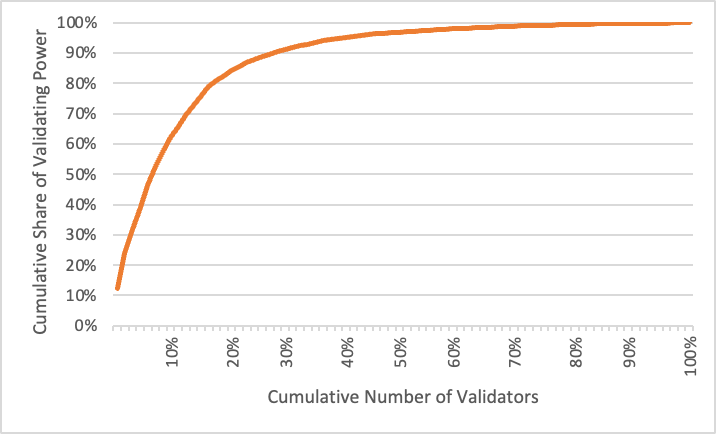

Those developers might steer away from Polygon, given the high centralization of validators. Polygon has only 83 validators, and the largest three validators together control almost 1/3 of the mining power.21 Should they decide to attack a network, they probably would not hesitate to do so.

One might argue that the difference in security might not be an issue for Polygon in terms of attracting users in a battle with Arbitrum. A less-security-sensitive user faced with a choice between Arbitrum and Polygon might easily choose Polygon. However, the security deficiency presents a different question. Why would a user or a developer choose Polygon if he can use Solana? Solana has the same maximum 65,000 TPS, with the potential to reach 710,000 in the future, and has a less centralized validator set.2223 There are obviously other differences in the networks. Still, the unflattering direct comparison to Solana will undoubtedly hurt Polygon.

Polygon’s Consensus Mechanism

Despite the security disadvantage, Polygon’s consensus mechanism offers faster withdrawals and enhanced scalability. Polygon's Proof of Stake bridge allows for withdrawals in only three hours, compared to Arbitrum's two-week minimum. That is because Polygon's PoS validators manage the bridge relay mechanism. Tokens on the Polygon blockchain will be minted after at least 2/3 of Ethereum's validators have confirmed the locked token event. Using its own PoS also enables Polygon to process transactions faster. Its maximum TPS is 65k compared to Arbitrum’s 40k.

Polygon is currently working on both optimistic and ZK-rollups. However, In the blockchain world, whether the Polygon PoS chain is indeed a Layer 2 scaling solution is a hot topic. Technically speaking, Polygon's PoS chain is a sidechain rather than a roll-up since transactions are posted to the PoS chain one at a time instead of being combined into one large batch before being sent to Ethereum. The transactions on the PoS chain are cheaper than publishing to Ethereum itself since it is a separate chain linked to the Ethereum mainnet via a two-way bridge. There is a cost, however, since sidechains do not share in the safety of the main chain they are attached to. Unlike Ethereum's 400 thousand validators, just 100 PoS nodes must submit transactions to the Polygon chain.

Multi-Sig Reliance

Arbitrum’s security advantage is not compromised by using a multi-sig controlling its smart contract. On the other hand, Polygon uses a 5/8 multi-sig that controls $5 billion worth of tokens. 4 out of 8 key holders are members of Polygon’s team. Hence, compromising a single outsider, all of whom were chosen by the Polygon team, would enable the Polygon team to “rug the network”. A more probable danger is an innocent mistake causing the keys to get leaked. The set-up is remarkably like the Ronin bridge hack for $625M. Ronin used a 5/9 multi sig, with four keys controlled by members of the Sky Mavis team and a fifth key temporarily lent out to Sky Mavis. A hacker managed to get into Sky Mavis systems, extracted the keys, and stole the funds. The danger regarding Polygon should not be overlooked. Even though Polygon is moving away from the multi-sig, its use demonstrates the relative leniency regarding security demonstrated by the Polygon team.

Privacy Features

Arbitrum’s Privacy Features

Arbitrum improves its user value proposition by introducing novel privacy features. Arbitrum’s virtual machines can be private, enabling the creation and “execution to completion” of VMs without revealing the code and execution.24 Since Arbitrum validators, unlike their Ethereum or Polygon counterparts, don’t execute the virtual machine code, the contents of the contract can stay hidden. This allows for the existence of private smart contracts and improves Ethereum’s privacy. Though this might be less relevant to retail users, developers might find value in the feature, helping Arbitrum establish an ecosystem edge.

Polygon’s Privacy Features

As mentioned earlier, Polygon Nightfall makes it possible to trade finance and supply chain tokens privately. Those holding the tokens will be able to view the complete history of where it has been. But, everyone else will not be able to decipher the history of where the token has been. Secure, private token transfers have never been possible before, especially at nightfall's insanely low fees.25

Polygon also recently introduced Polygon ID. Polygon ID is a decentralised ID platform focused on attaining SNARK-based privacy.

Scalability

“The ability to become what the platforms are trying to become ultimately depends on how scalable they are."

Scalability has two vectors: speed and cost-efficiency.

Transaction Speeds

Polygon boasts a higher headline transaction throughput of around 65,000 TPS, compared to Arbitrum’s 40,000. However, with regards to scaling solutions, speed is arguably the least important one since any speed difference between scaling solutions will be marginal, as they are naturally designed to speed up the base network significantly.

Cost Efficiency

Outsourced Security Grants Arbitrum Superior Cost-Effectiveness

Polygon is often hailed as a cheaper solution for scaling. The average headline cost of transactions in the past 60 days was around $0.02.2627 This ignores the high cost of running the network that MATIC token holders currently hold. Polygon has allocated 1.2 billion MATIC tokens to be emitted over 5 years to stakers. Currently, MATIC is being emitted to stakers at an annualized rate of 247 million tokens per year.28 This represents a $220 million yearly expense at current prices for 2.8 million daily transactions. That represents a cost of $0.2 per transaction.

Arbitrum’s fees are around $0.08 for swapping ERC-20 tokens and $0.03 for swapping ETH. Adding the roughly $17,139 a day Arbitrum spends for Ethereum’s security, divided by its daily transaction throughput, yields a total cost of $0.07-$0.12, or 60% lower than Polygon’s.29 Though the per-transaction difference is meaningless, it carries implications for the networks’ overall economics. The 60% difference right now is subsidised by MATIC holders, who lose value with every token emitted to validators. These rewards, however, are scheduled to stop in 2025 compared to Arbitrum’s $0.04, making Polygon’s cost of base layer security 20x that of Arbitrum.

Figure 5. - Arbitrum’s Cost of Security Figure 6. - Polygon’s Cost of Security

The superior cost-efficiency stems from an efficient implementation of the Optimistic Validation mechanism. Arbitrum’s multi-round fraud-proof system, which makes two parties narrow down the point of the dispute over fraud, ensures that the part of the transaction that is sent to layer 1 to be executed for verification is as small as possible. Hence the execution is as inexpensive as possible.

Polygon’s Cost-Effectiveness

Since Polygon is a sidechain and transactions are not uploaded to Ethereum; the average transaction fee has often been between 1 and 2 cents. According to Polygon's most recent quarterly report, the average transaction fee in Q2 2022 was $0.018.

In contrast, Arbitrum allocates the fee for uploading a batch of transactions to Ethereum between the individual transactions in the batch. The lower the per-transaction cost, the more transactions per batch may be handled by the rollup. Sending ETH on Arbitrum costs an average of $0.25 at the time of writing, while more complicated transactions, such as token swaps, cost an average of $0.41.

It's vital to note that the MATIC token used for Polygon transactions is not the same as the ARC token used for Arbitrum payments. Although Polygon and Arbitrum are less expensive than Ethereum, the gas prices on Arbitrum are still high enough to discourage people from adopting the chain. Polygon's cheap gas prices attract more users and open up new possibilities for the platform's applications. For instance, when consumers need to spend $0.25 to submit a payment of $1, the arbitrum micropayment system becomes meaningless. However, on Polygon, the identical transaction costs just one cent, significant savings over other Web2 services like PayPal. Strong adoption of Polygon may be seen in developing regions where optimistic rollup gas costs are still too expensive because of the blockchain's focus on making the technology accessible to users of all backgrounds.

Summing it all up

Otakar Korinek

Users should not hesitate and use Arbitrum if they are looking for a cheaper and faster way to use the Ethereum network. Arbitrum offers a cheaper cost of participating on the network, better security, and a more voluminous ecosystem. That is not to say Polygon is a bad scaling solution; however, in the relevant metrics, Arbitrum outperforms its competitor. The only relevant aspect where Polygon outperforms is speed. However, I would argue that, regarding scaling solutions, speed is the least important one since any speed difference between scaling solutions will be marginal, as they are naturally designed to speed up the base network significantly. Rather than speed, users should consider the user experience and ecosystem quality, cost efficiency, and security. Due to that, I would argue that users should use Arbitrum rather than Polygon.

Rohan Daswani

After considering the aforementioned factors, we have determined that Polygon is superior to Arbitrum in terms of scalability, user experience, technology, and discoveries. Polygon combines the advantages of Ethereum and sovereign blockchains to create a fully functional multi-chain system. Polygon addresses problems inherent to Blockchains, such as expensive gas prices and poor performance, without compromising on security. Polygon addresses these issues by offering a decentralised framework for executing cheap transactions. Although speed and fees may not matter that much as the difference is marginal, Polygon is the option that has been around for much longer and is far more reputable. For this reason, users tend to trust Polygon. Polygon has been around since 2017. Each polygon blockchain has its own functions independent of Ethereum. Polygon has been very aggressive with their fund, and companies choose Polygon because of its massive support to developers. Polygon has numerous projects they have been working on, which is a testament to their experienced developers. Businesses pick polygon for their experience as they know how to develop a business. Their track record is extensive. Polygon has become the go-to partner for traditional businesses to venture into Blockchain. Polygon also has unique advantages such as its diversified investment portfolio. For example, Polygon has been working on gaming, EVM zk-rollups and more. For these reasons, I think you should stick to Polygon.

https://beincrypto.com/ethereum-eth-tvl-loses-more-than-2-9b-as-merge-approaches/

https://pixelplex.io/blog/polygon-vs-arbitrum-vs-optimism-comparison/

https://polygonscan.com/chart/active-address

https://cointelegraph.com/news/offchain-labs-launches-arbitrum-one-mainnet-secures-120m-in-funding

https://blockworks.co/news/polygon-to-power-starbucks-nft-loyalty-program

https://learn.bybit.com/defi/what-is-gmx-crypto/

https://siliconangle.com/2022/08/09/offchain-labs-launches-arbitrum-nova-blockchain-gaming-social-media/

https://beincrypto.com/learn/what-is-arbitrum/

https://dune.com/sixdegree/arbitrum-overview

https://defillama.com/protocol/quickswap-dex

https://defillama.com/protocol/gmx

https://app.flipsidecrypto.com/dashboard/xEjzRC

https://blog.switcheo.com/huge-gains-on-polygon-2/

https://res.cloudinary.com/drw/image/upload/v1664462281/comm-cumberland/uploads/Cumberland_Crypto_Insights_-_Polygon-_Onboarding_the_Next_Wave_qrpsks.pdf

https://coinmarketcap.com/currencies/gmx/

https://coinmarketcap.com/currencies/gmx/

https://dune.com/sixdegree/arbitrum-overview

https://polygonscan.com/chart/active-address

https://defirate.com/staking/eth

https://staking.staked.us/matic-staking

https://polygonscan.com/stat/miner?blocktype=blocks

https://www.coindesk.com/tech/2022/05/03/heres-why-solana-ceased-block-production-for-seven-hours-on-saturday/

https://solanabeach.io/validators

https://www.usenix.org/system/files/conference/usenixsecurity18/sec18-kalodner.pdf

https://dappradar.com/blog/what-is-polygon-nightfall

https://polygonscan.com/chart/transactionfee

https://polygonscan.com/chart/tx

https://messari.io/asset/polygon/profile/supply-schedule

https://l2fees.info/l1-fees